Chapter 5

Infrastructure, Deregulation, Universal Service, Universal Access

Consumers in all regions of the Nation, including low-income consumers and those in rural, insular, and high-cost areas, should have access to telecommunications and information services, including interexchange services and advanced telecommunications services that are reasonably comparable to those services provided in urban areas and that are available at rates reasonably comparable to rates charged for similar services in urban areas. . . . [1996 TCA, section 254]

The term advanced communications capability is defined, without regard to any transmission media or technology, as high-speed, switched, broadband telecommunications capability that enables users to originate and receive high-quality voice, data, and graphics, and video telecommunications using any technology. [1996 TCA, section 706]

With those words, the U.S. Congress enshrined into law a commitment establishing nationwide access to a broadband hypercommunication network that would serve all areas of the country, including rural areas. The new legislation represented an important departure from the previous state and federal approach to communications because of sweeping deregulatory provisions combined with an attempt to reduce regulatory asymmetries. Under the 1996 Telecommunications Act (TCA), rural interests (including agribusinesses, their customers, and suppliers) have the right to access a greater range of hypercommunication services than the traditional telephony services they had been entitled to under the 1934 Communications Act. Additionally, the new, high-speed services had to be offered at prices that were "roughly comparable" to those offered to customers in urban areas.

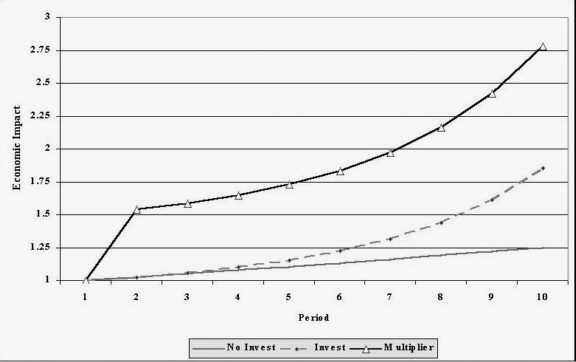

Chapter 5 discusses the how and where of hypercommunications infrastructure and regulation. How refers to how deregulation, re-regulation, taxation, and policy goals such as universal access and universal service will be used as mechanisms to help determine where infrastructures are deployed and access is available. The economics of policy responses influence how and where infrastructures will be developed, and what kinds of hypercommunication services will be available to Florida's agribusinesses.

Details of specific infrastructures were found throughout Chapter 4, especially 4.3.2 (telephone), 4.3.3 (Cable TV), 4.3.4 (fiber backbones), and 4.4 (wireless). Service availabilities and the unique hypercommunication needs of Florida's agribusinesses are illustrated in detail in Chapter 6. However, the availability of access to high-speed networking services may be determined by hypercommunications policy in some parts of Florida. A related question to be covered in Chapter 5 is how much competition there will be in the provision of hypercommunications to agribusiness and rural areas. Part of this answer depends on regulation, while part depends on the hypercommunications market structure, which is covered in Chapter 7.

As hypercommunications become more of a requirement for profitability and growth in a world economy linked by better communications, rural communities and producers without adequate access to hypercommunications could become marginalized. Furthermore, agribusinesses that must rely on infrastructures in such under-served areas are a disadvantage compared with domestic or international competitors who enjoy better access.

The Chapter begins with a brief overview of rural Florida's hypercommunications environment in section 5.1. Section 5.2 covers the meaning of other central concepts of the regulatory setting: a discussion of what the term rural means, along with definitions of infrastructure, universal service, and universal access. Section 5.3 traces the regulatory history of wireline and wireless communication infrastructures, pointing out how the converging hypercommunication sub-markets (mentioned in the latter half of Chapter 4) diverge from the market definitions of the regulators. Section 5.4 considers several rationales for government involvement in hypercommunication sub-markets. Brief economic analyses of specific mechanisms that are being used currently to extend service to rural areas and regulate hypercommunications in general are given in 5.5. Section 5.6 presents a conceptual model that is then used to analyze three general topics in the economics of utility regulation given that convergence and technical change are outpacing regulation. Finally, Section 5.7 discusses several minor rural development measures some that can directly help agribusinesses with hypercommunication planning and needs. Since regulation plays such an important role in geographical market definition, Chapter 6 will use results from Chapter 5 to look at how market boundaries make the local hypercommunication market facing Florida agribusinesses difficult to regulate and define.

5.1 Overview of Florida's Rural Hypercommunications Environment

For many agribusinesses, all or part of their ability to hypercommunicate depends on whether carriers extend inexpensive high-speed access to services in rural areas. However, the cost per subscriber of the rural hypercommunications infrastructure is high compared with urban areas, due to low population densities and other factors. This section gives a brief overview of how high-speed network access technologies affect the rural hypercommunications environment.

One way to understand the magnitude of the problem of extending hypercommunications to rural areas is by examining available data. An excellent source to start with is the FCC's HPCM (Hybrid Proxy Cost Model) data on all telephone, T-1, ISDN, and DSL lines (local loops) in Florida [FCC, CCB, 2000]. HPCM is a model used to estimate the forward-looking cost of providing "advanced telecommunications services" to high-cost areas [Bush et al., 1998]. The FCC and state utility commissions gathered information about the locations of all local loops throughout every state. The HPCM data are summarized at the exchange or wire center levels on down to small GIS (Geographic Information System) clusters.

Some of the extremes shown in Table 5-1 help to frame the issues involved in rural areas. The heart of the wireline access policy problem is summarized through five variables: average cost per loop of providing, average copper loop length, maximum copper loop length, total area of each exchange or cluster, and line density per square mile.

Source: FCC Common Carrier Bureau, 2000.

First, average costs per loop in rural exchanges tend to be high when compared with urban ones. It costs over ten times more per local loop to provide POTS (Plain Old Telephone Service) to Kenansville than it does to parts of Jacksonville. When it comes to DS-0 and higher dedicated lines and circuit-switched circuits the differences in costs are even larger. The investment cost of such dedicated and direct circuits ranges from $0.40 per line to over $600 per line per month (in addition to loop costs), depending on the area's infrastructure and average connection length [FCC, CCB, 2000]. Such dedicated and direct loops provide businesses with access to enhanced telecommunications services, private data networking, and the Internet. With these dramatic differences in costs, it is hardly surprising that the full menu of enhanced telecommunications and high-speed data and Internet access are unavailable via telco lines in many areas of Florida.

The area covered by a CO or wire center is another important variable. For example, as Table 5-1 shows, the Lake City CO serves over 400 square miles, while certain COs in both Miami and Jacksonville serve areas smaller than two square miles. Large serving areas are correlated with longer loop lengths. Loop lengths stretch up to 468,000 feet (over eighty miles) in Sprint's Everglades exchange with the average loop length there at almost 138,000 feet. Perrine (south of Miami) has one cluster with an average loop length of over 343,000 feet, while clusters in the downtown Miami Grande exchange are only 465 feet on average from CO equipment.

The longest loop in any cluster in Miami's Grande exchange is 999 feet, while the longest loops in dozens of clusters in other exchanges exceed 100,000 feet (almost nineteen miles). Loop lengths determine two things. First, many circuits such as DSL and ISDN cannot be offered on loops of 18,000 to 35,000 feet or more. Other circuits such as dedicated T-1 lines can be offered to points at greater distances, but only at enormous expense. The added expense results because longer distances may require older transmission technologies that need repeaters every two to six thousand feet, specially conditioned lines, and other expensive qualifying factors. Even 56 kbps modems will not transmit at full speed over long loops. As many as twenty percent of all loops in Florida are 24,000 feet or further from CO equipment.

Line density per square mile is another statistic used to determine where high-speed access technologies are likely to be profitable (and hence, deployed). There are enormous teledensity variances within Florida. For example, the Miami Grande exchange has over 120,000 lines per square mile, while Belle Glade has 0.84 lines per square mile. The sparsest area of all is a cluster within the Eglin AFB (in the Panhandle) exchange served by Sprint that has 0.66 loops per mile. ILECs are reluctant to invest in new infrastructure for sparsely settled areas with low densities per mile. Table 5-2 shows the number of total, business, special, home, and single-line business lines per teledensity category in BellSouth's service area during 1999. Teledensities are frequently a favored way to analyze communications and geography because they are correlated with service levels and costs [Kellerman, 1997].

Source: FCC CCB (2000), HMWKFL2151919999.xls, Excel spreadsheet.

According to Table 5-2, under ten percent of the 1.8 million multiple business lines and trunks were in areas with densities below 850 lines per square mile, and almost one-third lay in areas with over 5,000 per square mile densities. Almost twenty percent of households and single-line businesses were in areas with densities below 850 lines per square mile, with a smaller percentage located in areas with over 5,000 lines per square mile.

Figure 5-1 shows the distribution of loops among teledensity categories. Roughly, about sixty percent of all lines are located in areas with a teledensity of 850 to 5,000 lines per square mile. Approximately twenty-five percent are in areas with higher densities than that and fifteen percent in areas with lower teledensities than 850.

Low subscriber densities and long local loops are not new problems. However, both result from achievement of two former policy objectives of ILECs: deploying POTS lines in high-cost rural areas at prices comparable to other areas and extending POTS to previously unserved places. The REA (Rural Electrification Administration) and RTB (Rural Telephone Bank) were two federal programs that were used to build previous generations of POTS infrastructure in high-cost, low-density rural areas. However, these programs were targeted towards the service territories of small co-operatives and independent ILECs that were certified as rural carriers.

Most of Florida (rural and urban) is served by three large ILECs: Sprint (serving territories of the former Central and United Telephone Companies), GTE (now merged with BellAtlantic-Verizon), and BellSouth, an RBOC (Regional Bell Operating Company). The three large ILECs are classified as non-rural carriers though they serve over ninety percent of Florida's area. Generally, the specific design of rural loop plants in non-rural-certified carrier areas has been left up to the carrier. Often, plans for dedicated circuits, circuit-switched ISDN, and data transmission were left out since the law mandated POTS alone.

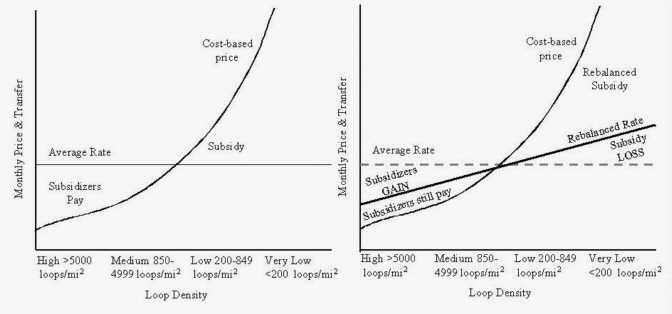

In addition to special programs for rural carriers, traditional services and technologies have been subsidized, regulated, and taxed to achieve price equity between urban and rural areas. The methods that have been (and are being) used typically include rate averaging (5.5.1, 5.6.2) and rate of return regulation (5.6.3) by the FPSC. Price cap regulation (5.6.3) is used for non rural-certified carriers. More detail about specific mechanisms is presented in section 5.5, but essentially three transfers (along with overall utility regulation) are used to accomplish the extension of service.

First, business telephone rates are used to subsidize residential service. Prices for business service average two to three times that of residential customers in part so that businesses (which tend to be located in higher teledensity areas) will subsidize residential service (which tends to be found in lower teledensity areas). Second, urban and suburban rates (of businesses and residences) subsidize wireline service to rural areas. Hence, customers in low-cost areas (such as Jacksonville or Miami) pay almost the same rate for telephone (and some other tariffed services) that rural customers in Kenansville or Okeechobee do. These equal costs are charged although it may cost the ILEC ten times or more to provide rural service. The third transfer is through taxation and direct subsidy so that telephone companies that serve high-cost areas are compensated directly for the costs that cannot be met through either of the other two methods.

One bit of evidence supporting the success of these ILEC programs in improving the rural telephony infrastructure can be seen in Figure 5-2. DLC-RAV (Digital Loop Carrier-Remote Access Vehicle) access loop hardware is how the overwhelming majority of telephone subscribers in areas with densities below 850 lines per square mile obtain service. Interestingly, the 850-2,499 teledensity category has a much lower deployment of DLCs and fiber in the loop than more urban teledensities shown on the right.

Cynics argue that Figure 5-2 is evidence of two separate developments rather than one positive one for high-speed access. BellSouth has extended DLC-RAV solutions to many rural areas to save itself money, since many deployments in those locations cannot support high-speed services because of the DLC-RAV equipment used there. BellSouth is now extending newer DLC-RAV technologies (capable of supporting high-speed services) mainly in denser areas (at the right of Figure 5-2) that are financially able to support DSL and other high-speed services.

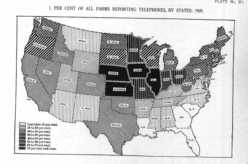

Before the 1934 Communications Act established a federal mandate to improve rural communications, even the telephone was still far from universal in the United States, especially in poorer, more rural areas. Rural America was considerably behind the rest of the nation in communications infrastructure and Southern rural America even more so. In 1920, for example, fewer than ten percent of Florida farms reported telephones, compared to a national average of 50 percent [Statistical Abstract of the United States, 1924, p. 305].

Now rural areas of Florida have basic traditional telephony services and some enhanced telecommunications services. However, the capacity of rural networks to handle enhanced services varies dramatically. Depending on location, high-speed wireline services such as DSL or ISDN-PRI may be unavailable or prohibitively expensive to all but the largest agribusinesses. Although rural Florida has a reasonably high cable TV pass rate, broadband networks built by Cable TV companies do not extend outside city or town limits to low density areas in most cases. Electric utilities including rural cooperatives have begun to provide retail high-speed access to their "dark fiber" capacities. However, most rural electric co-ops either partner with telephone co-ops to deploy high-speed wireline access or remain focused on electricity alone.

Wireless is often seen as the solution for many rural customers. However, in addition to the technical barriers mentioned in 4.4, access varies. Satellite TV services are widely available, but satellite-based telephone and Internet offerings can require expensive CPE and offer asymmetric data rates. DirecPC, the most popular satellite Internet service requires a telephone modem for the upstream path and offers only 400 kbps downstream. Fixed wireless may depend on unobstructed horizons or thunderstorm-free conditions. Many of the most promising fixed wireless technologies such as MMDS and LMDS are not yet deployed and will be targeted towards office building users when they are. Cellular and PCS carriers are beginning to offer third generation services where no long-distance charges prevail; yet, these may lack full functionality in rural regions. In addition to other regulation, wireless hypercommunications is subject to FCC spectrum allocation rules (covered in 5.5.4).

5.2 Rural, Infrastructure, and Universal Service

Now that a brief overview has been given, it is time to provide a better idea of three essential terms used in hypercommunication policy as it applies to agribusiness. This section covers dimensions of infrastructure (5.2.2) and the meaning of universal service and its high tech twin, universal access in 5.2.3. Before these topics can be covered, a few words must be said about the meaning of the word rural. The definition of what constitutes a "rural" area is much more difficult than it at first appears.

5.2.1 Definitions of Rural

The Department of Census, USDA, U.S. Congress, Department of Commerce, FCC, postal service, zoning, and public safety agencies each have different definitions of how populated a certain geographically configured area must be to be called rural. However, when using the term rural with respect to hypercommunication policy, mere recitation of legal, zoning, Census, or USDA definitions is insufficient. The definition of the term rural is also used to divide Florida ILECs (and other carriers) into rural-certified and non-rural-certified to allocate 1996 TCA subsidies that support the extension of service to rural areas. Precise definitions of rural can be obtained with GIS data that pinpoints population densities for any location.

In Figure 5-3 [U.S. Census Bureau, 1998], the 1990 population density of each Florida County is shown. By 1998, the density for the entire state stood at 274 persons per square mile. The same recent Census estimates showed that Pinellas County (Saint Petersburg) is still the most densely populated County with over 3,185 persons per square mile. Pinellas is followed by Broward County (Fort Lauderdale) with 1,185, Seminole County (Sanford) with 1,146, Miami-Dade County (Miami MSA) with 1,065, Duval (Jacksonville) Hillsborough County (Tampa) with 893, and Orange County (Orlando) with 889 persons per square mile.

Then, a host of less populated cities and counties fall in the 333 to 485 persons per square mile range. Included in that category are Sarasota county (Sarasota), Lee county (Fort Myers), Palm Beach County (West Palm Beach), Escambia (Pensacola), Volusia County (DeLand and Daytona Beach), Manatee County (Bradenton), Brevard County (Melbourne-Cocoa), and Pasco County. In 1998, the least densely populated counties were Liberty (9.3 persons per square mile), Glades (12.7), and Lafayette (13).

These county-level data show that some areas are more sparely populated than others are. However, communication networks rely on the distribution of population around access nodes such as COs and other POPs. In many counties, the density figure may be artificially low because of unusable wetlands (as it is in Dade, Broward, and Palm Beach counties), and the presence of federal or state land. The tendency to define an entire county as rural or urban based on census characteristics of the whole county's land area is therefore flawed. However, this is not the only problem with defining rural.

There are two additional problems with using county densities to define rural for hypercommunications before several alternative definitions of rural are introduced. First, densities in the fastest-growing counties are creeping higher as agriculture loses land to urbanization. Figure 5-4 [US Census Bureau, 1995]shows U.S. Census estimates of growth by county from 1990-2000, as estimated by the U.S. Census bureau in 1998.

The top three 1990-2000 county population increases in percentage terms were projected to occur in Osceola, Hernando, and Flagler Counties. However, recent estimates suggest that Flagler, Liberty, and Sumter County will each achieve population growth of over 40% from 1990 to 2000. In total numbers, five counties are expected to see increases of over 100,000 people: Broward (180,000), Palm Beach (151,000), Miami-Dade (146,000), Orange (136,000), and Hillsborough (102,000).

Second, average densities of rural population do not tell the whole story concerning the market for hypercommunications services. If rural residents are widely scattered, one technology (wireline or wireless) may be better than another depending on how density is defined. Widely scattered could mean 900 people in a single cluster or 900 people in 900 equally spaced-apart dwellings, depending on how density occurs in reality.

Table 5-3 summarizes some of the more frequently used definitions of rural, giving the percentage of Florida's population that falls into each category along with some problems with that definition. The county-based definitions of rural and urban used by the Census Bureau have just been mentioned. Under the census metro versus non-metro county designation, 914 thousand of Florida's population (7.1%) was classified as rural in the 1990 census. An alternate Census definition of rural as persons living outside incorporated and unincorporated CDP places with fewer than 2,500 persons finds 1.97 million rural residents of Florida, making up 15.2% of the total population. The USDA economics agencies use several methods to define rural. For the most rural definitions, a mere 28 thousand inhabitants of three counties made up a small fraction of one percent of the total population.

Sources: ERS, 1993, US Census Bureau, 1995; RTF, 2000, p. 21.

FCC rural-designated carriers served a population of 193,000, 1.5% of the state's population on 14% of the land area. The 1996 TCA defines rural telephone companies as those that do not serve either any incorporated location larger than 10,000 inhabitants or to any territory incorporated or unincorporated that is within an area designated as urban by the Census Bureau [Egan, 1996, p. 264]. Regardless of what other definition of rural is used, the FCC rural-designated carrier definition clearly understates the number of rural Floridians. Using almost any other definition of rural, most residents of rural Florida are served by BellSouth, GTE, or Sprint. None of these three large multi-state ILECs meets the 1996 TCA litmus test for rural-designated carriers.

Unincorporated places had over 6.5 million inhabitants, just over 50% of the state's inhabitants in 1990. While most of the population in these locations could not be classified as rural, almost all rural land falls inside unincorporated areas. Each definition has its own strengths and weaknesses as shown in Table 5-3.

Even with a particular definition, the actual physical task of locating, marking, and defining fast-changing parts of the state are difficult. In the FCC HPCM database, a GIS (Geographic Information System) is employed to map communication network nodes, telco exchanges and wire center, flows, directions, and network topologies [FCC, ACC, 2000]. An enormous body of data for nodes, exchanges, ILECs, and regions is available such as that summarized in Table 5-1 and Figures 5-1 and 5-2.

Several final points help characterize the meaning of rural in the agribusiness hypercommunications context. First, rural is not necessarily agricultural and agricultural is not necessarily rural. The proportion of total economic activity in small communities resulting from agriculture varies dramatically, but in all but a few cases is less than half. Estimates of the amount of agribusiness value added in rural or suburban versus urban facilities are hard to find. Typically, the farm gate price (received by farmers or growers themselves) is a small fraction of the full retail price. Depending on the product in question, as much as ten or fifty times of value is added off the farm at processing plants, warehouses, or packaging facilities in urban areas or small towns. Agribusinesses in these areas have a better chance of getting high-speed hypercommunication services than most farms do.

Second, rural and remote are not necessarily synonyms. Compared to states in the western US, teledensities in Florida are not low. Where they are, in many cases long loop lengths do not lead to isolated farms or sugar plants, but instead to vacation hideaways, hunting and fishing facilities, or private islands [Egan, 1996].

Another argument is often heard that if residents of rural areas want high technology, they should move to areas where it is available rather than vice versa. Characteristics of non-metropolitan residents are often generalizations, but many people gain considerable utility from living in rural areas.

Roper organization surveying, published in 1992, shows that 83 percent of non-metropolitan residents say they are family oriented; 69 percent identify themselves as having a strong commitment to their community (only 5 percent of metropolitan residents do). Rural residents are much more likely to give their communities high marks for personal values, friendliness, cost of living, police protection, recreational facilities, low pollution, and quality of life for themselves and their children. Sixty percent of rural residents think their community is moving in the right direction, only 36 percent of urban residents do.

That Roper survey shows 33 1/3 percent of Americans believe that rural America is the ideal place to live--and 35 percent of all Americans say they would like to be living in a small town in 10 years. [Doll, 1996, pp. 237-238]

This argument may be particularly true of the increasing number farms and ranches where most income comes from off the farm. Over 13,000 of Florida's 34,000 farm operators spent over 200 days off the farm in 1997, while over 19,000 reported that their principal occupation was not farming [USDA NASS, 1997 Census of Agriculture, Table 1].

Furthermore, not all rural residents can move at will, even if they wanted to. This is particularly true of certain agribusinesses because assets are fixed. Hypercommunications infrastructure must come to the rural customers if they are to have access to high-speed networks.

5.2.2 Infrastructure Dimensions

Just as rural has more than one conceptualization, so too does infrastructure. Rural Florida's communications infrastructure is often erroneously equated with the PSTN (Public Switched Telephone Network) operated by the monopoly ILEC (Incumbent Local Exchange Carrier). That same wireline infrastructure may be unbundled and resold or used to interconnected to networks controlled by IXCs, ALECs, ISPs, or wireless carriers. Infrastructure is the physical plant through which a service provider offers access to the hypercommunication network and value added services to subscribers. Next, the dimensions of infrastructure are considered on several levels.

Some authors (Hubert, 1996) use the term infostructure to dramatize the difference between "information communications infrastructure from more traditional national systems such as: transportation, power generation and resources, natural resources, education, water, sewer, health care, housing, and the postal service" [Hubert, 1996, p. 21]. Hubert defines infostructure (what this study calls hypercommunications infrastructure) as:

The combination of all the elements of a country's information communications infrastructure, which would include the following capabilities related to the creation, capture, storage, processing, transmission, and reception of all forms of information: transmission facilities, information services (cable, fiber, wireless) gateways/utilities, switching, terminal equipment/receivers, network management software/systems, data storage devices, broadcasting equipment, computers and data processing equipment, software operating systems and utilities, financial settlement systems, data capture devices, security/validation systems, applications software, and data/content libraries. [Hubert, 1996, pp. 91-92]

While part of a modern business' infrastructure consists of local level devices it owns (CPE), an agribusiness connects to the outside world using a carrier's access infrastructure. Indeed, the CPE the agribusiness buys depends on the access infrastructure. There is no point in purchasing fiber optic transceivers if analog POTS lines are the only wireline connection in an area.

Chapter 4 discussed (in section 4.3) the differences among copper, coaxial, and fiber optic wireline conduit as well as the frequency spectra over which wireless communications paths are beamed. Chapter 4 also explained the differences between the QOS reference model (access level, local level, and transport level) with the OSI layers of data communication. It becomes important to capsulize that material so that the most important incentives and barriers to infrastructure development can be discussed free from technical detail.

Table 5-4 shows some of the main aspects of outside infrastructures that could serve agribusiness. Rows of the table feature the four general hypercommunication sub-markets from Chapter 4 along with essential high-speed technologies used to provide wireline and wireless access to the appropriate communication network. Since regulatory markets are defined somewhat differently (and these affect infrastructure directly), their influence is shown in the first column.

A full discussion of the technical details of most of the entries in Table 5-4 is given through reference to the appropriate section of the text. Each transmission technology (wireline and wireless) and each transport and service type has its own infrastructure dimension. The extension of a hypercommunications infrastructure to rural areas is often far more complicated than the narrowly definition of Table 5-4 allows.

Alternative network structures such as CATV, ISP-ALEC, or local electric utility grids represent attractive possibilities for rural areas, but have been less well-researched by firm R&D efforts when compared to ILEC and IXC R&D histories. Research by AT&T, Lucent, Bellcore (Telcordia), and the REA has examined almost every aspect of hypercommunications. So far, the sub-industry with the best long-run R&D record of accomplishment (telephony) appears poised to gain the largest market share of a converged hypercommunications industry except that regulatory burdens on telephony are the highest as well.

Importantly, regulatory constraints on services have shaped telephone industry R&D portfolios. During the years that AT&T was prohibited from the computer business, for example, R&D in that area worldwide suffered, so great was AT&T's position. AT&T (MediaOne), BellSouth, GTE (Bell Atlantic), MCI Worldcom, and Sprint (soon to be MCI-Sprint) are five of the top Florida hypercommunications providers with roots in the telephone industry. For many years, BellSouth as an RBOC was prohibited from hardware sales in the computer communications and telephony-related CPE markets while GTE, MCI, and Sprint were not. While asymmetric regulation prevent ILECs from offering long-distance and other services, the past monopoly status of AT&T and the RBOCs enabled them to spend generously on forward-looking R&D that still yield distinct market advantages.

Table 5-5 concerns an especially important dimension of infrastructure, how economists analyze costs of infrastructure development. Currently, most economists and regulatory authorities believe that forward-looking costs are the most applicable way of analyzing infrastructure costs [FCC, 97-160, 1997]. Egan defines forward looking as:

A descriptive term normally associated with incremental costing methodologies and techniques utilizing estimates of quantities, costs, and conditions that will prevail during a future period. It also implies costs yet to be incurred as opposed to costs previously committed. [Egan, 1996, p. 347]

Sources: Egan (1996, pp. 318-319); FCC, 99-5, February 1999; FCC, CCB, 2000; Zaatari, 1999; USDA-NTIA, 2000.

Table 5-5 shows Egan's summary of some of these AIC (Average Incremental Costs) for deploying various infrastructures on a per subscriber basis. Alternative sources (when available) have also been posted in Table 5-5 to obtain a range of estimates, both for 1996 and for 1998-2000. All AICs shown are broad estimates of nationwide averages. In some cases, especially wireline and cable, costs in parts of Florida would be lower than the national average.

It is important to note that most of the forward-looking costs for the services listed in Table 5-5 have dropped dramatically from Egan's 1996 survey to the present according to several sources. The cost decreases in some cases have come from lower conduit prices or improved efficiency as the installed base grows. In other cases, the decrease in costs is a result of technological advances such as new multiplexing or spread spectrum technologies that allow more traffic to be carried over a single wire or radio channel.

5.2.3 Universal Service and Universal Access

Having served as the main method of business communications for decades, telephone interests have created much of the current debate about Universal Service. Importantly, the term universal service was first employed by AT&T's Theodore Vail, who has been called the father of communications marketing. That early definition of universal service meant that service would be universally provided by AT&T and was akin to interconnection. Early telephone customers could not even talk with each other because of differences in equipment and lines. AT&T created de facto and later de jure standards that would eventually apply to the entire PSTN.

Universal service (and its high-tech cousin universal access) are the next essential terms of hypercommunications policy. Indeed, the specific policy mechanisms of universal service are covered in 5.5.1 and the topic occurs throughout Chapter 5. Therefore, it needs to be defined. The 1996 TCA defines universal service as "an evolving level of telecommunications services that the FCC shall establish periodically, taking into account advances in telecommunications and information technologies and services" [1996 TCA, Title 1, Sec. A]. More specifically, the statute conceived of seven policy bases of universal service as given in Table 5-6.

Sources: Bases from 1996 TCA. FCC, 2000; FPSC, 1999.

Local-state joint boards and the FCC were directed to "base policies for the preservation and advancement of universal service on" seven factors or bases [1996 TCA]. For each basis, the purpose and status are given. Some of the purposes behind universal service reoccur as rationales for overall government involvement in hypercommunications in 5.4 as well.

The first policy base of universal service is availability of quality services at just, reasonable, and affordable rates. The purpose is based on equity rather than directly on economics. However, if network externalities are positive, then spending on mechanisms to support the policy may bring more benefits to society than costs. There is some evidence that the policy has not been as successful as it might have been at promoting universal availability of telephone service. While 92.6 percent of Florida households have telephones, fewer than 80 percent of certain income and educational categories do [FCC, 2000; FPSC, 1999].

The second policy base is to ensure access to advanced telecommunications and information services to all regions of the nation. This is also known as universal access to underscore the fact that the goal is not restricted to analog POTS. Advanced telecommunications has been defined as 200 kbps or greater on a federal level [FCC CCB, FCC 00-290, 2000]. However, the FPSC states their goal is universal 56 kbps, but it will be as many as three years (until ILECs upgrade plants) to achieve even this base universally throughout Florida. Until 20002, 56 kbps is defined as broadband accessible in Florida [FPSC, 1999, p. 3]. Extending the definition to more advanced services is still under study by the FPSC. In September 1999, fewer than 40% of Florida COs could support DSL. However, enhanced telecommunications services are increasingly available in urban and suburban parts of Florida.

A third basis of universal service is that access and costs in rural and high-cost areas be reasonably comparable to those in urban areas. Rural rates are still balanced by FPSC regulations to ensure rough comparable. This subject is considered later as a mechanism of government involvement in 5.5 and in 5.6.2 in the context of universal access.

The fourth policy basis, equitable and nondiscriminatory contribution has probably not been met. ILECs and IXCs still bear the burden of paying support mechanisms. The incidence of the support fee on customer bills for extending universal service is such, the telcos argue, that all of it must be passed on to customers. While bills of large businesses have fallen drastically, bills for small businesses and residential accounts (especially for extremely low use customers) have risen up to thirty percent. The increase is partly attributable to the universal service fund and other charges and taxes resulting from the 1996 TCA.

Specific and predictable support mechanisms for universal service are the fifth policy base for universal service. Collected funds are subject to a variety of administrative formulas that regulators and telcos are still sorting out. Indeed, two new mechanisms have just been enacted by the FCC in the year 2000 [FCC, May 31, 2000]. However, the sixth policy base for universal service, access to advanced telecommunications services for schools, health care, and libraries; has been quite successful. An overwhelming majority of Florida schools (even in rural areas) has obtained advanced services through the Schools and Libraries program.

Finally, the 1996 TCA allows for dynamic adjustment mechanisms as needed. While the FCC has concluded that Internet traffic is jurisdictionally mixed (part local and part interstate), it has taken a hands off policy to regulation. Given the increase in low cost and even free IP telephony services, there have been calls by telcos for regulation of voice over Internet. While the FCC has ruled that Internet traffic is jurisdictionally mixed (and thus potentially subject to interstate-intrastate separations rules), the Commission has taken a hands-off approach to regulating the Internet. The FPSC and FCC have been considering numerous cases regarding reciprocal compensation, or how one carrier is paid by another for terminating calls, especially to ISPs.

According to some views (such as those of the rural communications lobby OPASTCO), deployment of infrastructure depends on the federal commitment to universal service. A recent OPASTCO study suggests that even if carriers plan to upgrade rural infrastructure, their ability to realize those plans "is largely dependent upon the universal service mechanisms enacted and the extent to which continued infrastructural upgrade is economically feasible." [Hobbs and Hobbs, 1998, p. 28].

Importantly, the term universal access is used instead of universal service to signify that universal POTS telephony or even universal enhanced telecommunications services leave out some important ingredients of the infrastructure of the future. As the NTIA-RUS report in June 2000 put it:

We urge the Federal Communications Commission to consider a definition of universal service and new funding mechanisms to ensure residents in rural areas have access to telecommunications and information services comparable to those available to residents of urban areas. [NTIA-RUS, June 2000, p. iv]

The idea here is to replace the current static definition of universal service as "both a voice grade bandwidth of 300 to 3400 Hz and a data rate of at least 28.8 kbps" [NTIA-RUS, June 2000, p. 42]. The new definition, universal access would be an evolving standard that would fulfill the requirements of the 1996 TCA to support advanced services that is more in line with the policy bases given in Table 5-6. The regulatory differences between universal service and universal access (the result of convergence) are discussed further in 5.6.

Before considering the economics of how specific universal service (and other regulatory mechanisms) operate, it is important to cover the history of regulatory and infrastructure to create the base scenario for the economic analysis of the chapter.

5.3 Regulatory and Infrastructure History

Economics provides an excellent context for studying the history of infrastructure and government actions in communications. To quote Louis Schmidt in 1916:

The agricultural economist needs to be familiar with the economic life of man in the past in order to realize and appreciate the organic nature of society. He should be historically minded if he would deal most effectively with the problems of the present?. The great problems of rural communities are human rather than merely materialistic. That is to say, they are economic, social, and educational, and cannot be understood except in light of their historical evolution. [Schmidt, 1916, p. 45]

Infrastructure development is important to agriculture because the rate at which it occurs is markedly different between rural and urban areas, as well as varying among regions of Florida. Re-regulation, taxation, and other policies are meant to speed up the development of infrastructure in markets that have been missed by the uneven pace of competition. Federal, state, and local governments have a variety of policy mechanisms designed to ensure universal service or rough parity among geographic locations in Florida. However, the regulations themselves can often lead to barriers to entry, limitations on service, and decreased competition. Public policy will influence the choices and costs many agribusinesses will face in the hypercommunications marketplace.

The history of how traditional telecommunications has converged with other sub-industries to create hypercommunications and the rural-urban infrastructure dichotomy depend on the four sub-markets presented in the last half of Chapter 4 but with a different organizational framework. However, the traditional telephony (POTS) and enhanced telecommunications infrastructure is considered first (5.3.1) because it is still Florida's widest in geographical terms, largest in dollar terms, and an important and measurable source of efficiency and coverage. Wireline access to enhanced telecommunications, private data networking, and the Internet are part of the same story. Agribusinesses still rely mainly on wireline local loops to access hypercommunication networks other than the PSTN.

The second regulatory history is of broadcast and wireless technologies (5.3.2). This segment covers a wide regulatory and historical territory, ranging from rural AM "daytimer" radio stations to international satellite networks capable of video, voice, Internet, data networking and broadcast transmission. Mobile services in this sub-market duplicate those of traditional and enhanced wireline services and interconnect to the PSTN through most of Florida. New fixed and mobile services are being introduced that can compete with wireline cable or telephone companies alike.

Before the 1996 TCA, regulation was enacted separately for wireline and wireless transmission technologies and services. Even after the TCA, ILECs are regulated differently from other telcos (ALECs and IXCs) who are regulated differently than cablecos and mobile wireless providers. The sources of these regulatory asymmetries are based on history, technology, and recent regulatory reform. Hence, after covering the wireline and wireless infrastructure and regulatory history, 5.3.3 looks at the 1996 TCA which was designed to update regulations to include the emerging reality of hypercommunications convergence.

5.3.1 Wireline Infrastructure History

No discussion of hypercommunications would be possible without a thumbnail sketch of the telephone system, as it has evolved over the last 122 years in Florida. Florida's hypercommunications infrastructure is a product of her Reconstruction days as an impoverished and remote Southern state, her unique right-of-way laws (stemming from the 1920's land boom), and her rapid growth after World War II fueled by Northern immigrants. However, the state's wireline infrastructure also includes enhanced telecommunications, private data networks, cableco networks, and Internet backbones and access methods. The result is an amazing diversity, with Yahoo! naming Miami the tenth most wired city in America in 1998 [Yahoo!, 1998].

Within the wireline category is a short history of new entrants including cablecos and so-called "dark fiber" providers (such as electric utilities) with existing fiber optic capacity, sometimes in rural areas. These providers have their own infrastructure economics that often allows them to supply FTTH (Fiber to the Home) or FTTN (Fiber to the Neighborhood) at less cost than telcos can. However, their existing plant (described in detail in 4.3) does not reach many rural areas and depends on each cable or electric company as to how (or whether) it has been developed. While access to the Internet and private data networks can be obtained through cableco connections, the main wireline source is still via telephony local loop.

The story of Florida's modern communications infrastructure begins after Samuel Morse's famous "What hath God wrought?" telegraph message sent to Baltimore from Washington, D.C., in 1844. With the first transatlantic telegram transmission in 1858, Cyrus W. Field was able to communicate to London from America. That inaugural transatlantic message would predate the first transcontinental one by three years, so important was the Northeast during the introductory years of the telegraph. Only in 1861, as the Union entered the Civil War was east west communication within the United States considered vital.

One reason the South suffered during and after the Civil War was her inferior telegraph system. After the War, when Western Union and later, the new Bell Telephone Co. began to expand the telecommunications infrastructure, some argue that the Reconstruction South was neglected. However, telephones were in use as early as 1878 in Jacksonville. By 1880, Florida's first telephone exchange opened there, a mere 28 months after the first CO started in New Haven, CT and four short years after the inaugural Bell-Watson conversation.

Instead of neglect, others say that the slow spread of the telephone southward was based on a marketing reality: there were too many rural, poor, and illiterate people in the Reconstruction South (especially Florida) for telephone service to be profitable [Oslin, 1992]. The few early telephone customers in Florida in 1900 had to contend with severe static and interference. At the turn of the century, the sunshine state had just over 520,000 inhabitants and but two large towns, Jacksonville with 28,000 people and Tampa with 16,000. Miami was a small town with 1,700 inhabitants and only 3 telephones. The essential role of transportation in the development of Florida's communications infrastructure as well as the agricultural settlement of the state as the 20th Century began cannot be overemphasized.

However, post-Civil War efforts at developing Florida's transportation infrastructure were stymied by many factors resulting directly and indirectly out of Reconstruction, as well as by Florida's rural, underdeveloped, backwater frontier image. One example of the difficulty the state had in developing an infrastructure can be seen by examining the Internal Improvement Fund. This fund enabled the state to finance (through bond measures) the construction of the railroad system during the 1850's. Postwar Florida's state government could not pay the bearers of these bonds in cash, and the bondholders refused land. In 1881, after federal courts were implored to force the state to sell land to satisfy bondholders, the state sold 4,000,000 acres of "swamped and overflowed" land for twenty-five cents an acre to Hamilton Disston [Patrick, 1945, p. 480]. It was then free to offer land grants to individuals desiring to make transportation improvements [Patrick, 1945, p. 87]. Therefore, it was not until the 1880's and 1890's that serious improvements to Florida's meager transportation infrastructure of the 1860's were begun.

However, even with some new railroads and roads, by 1920, Florida's rural communications infrastructure was still behind every other part of the country except for Louisiana, Georgia, and South Carolina as Figure 5-5 shows [US Census Bureau, 1924, p. 305].

During the 1920's, parts of urban Florida had become a vacation mecca for wealthy northern tourists who demanded better communications. Henry Flagler launched a modern railroad to deliver tourists by train, Collins built the Dixie Highway to deliver tourists by auto, and Florida's agribusinesses required better roads and railroads to deliver their goods to market. Rather than bring a universally better communications infrastructure, the new transport structure brought about a tradition of what USWest Chairman Solomon Trujillo calls "electronic redlining". The most modern telephone plants were installed only in particular areas, with minority, rural, and poor areas left with below average services and aging equipment.

It only took a generation for the telephone to become a luxury status symbol in urban America. It would take longer to reach rural America to become a status symbol there while becoming commonplace on the urban scene. By the later years of the Great Depression, in 1938, fifty years after the telephone arrived in Florida, telephone service was either non-affordable or not available to many Floridians. While firmly established in the city, it would take programs such as the REA (Rural Electrification Administration) telephone bank, a depression-era federal agency, to establish co-operatives to serve certain rural areas.

Federal regulatory history began with the 1910 Mann-Elkins Act, the first legislation to regulate telephone rates. The Act was enforced by the ICC (Interstate Commerce Commission). By 1921, Congress passed the Willis-Graham Act allowing the ICC to administer acquisitions and mergers in the telephone business. The 1934 Communications Act turned authority over to a new agency, the FCC.

By 1948, wartime wireless breakthroughs caused the FCC to force AT&T to carry television signals at regulated rates and AT&T was powerless to stop TV network microwave networks that were separate from the PSTN. Wireless technologies resulted in the eventual competition in long-distance. Additional background to the history of wireless regulation is found in 5.3.2.

In 1949, the federal government brought the action United States vs. Western Electric based on the Truman Administration's public philosophy. The government contended that AT&T should divest itself of Western Electric (its wholly owned subsidiary) that made all business and residential telephones and virtually all telephone infrastructure equipment. The settlement of the case did not come until 1956 and was seen at the time as a victory for AT&T because AT&T's structure was left almost unchanged. By this time, Western Electric had withdrawn from making TV, radio, and other non-telephone equipment. In the 1956 settlement, AT&T agreed to stay out of equipment markets outside of the telephone industry. However, valuable patents developed by the Bell System had to be licensed at reasonable rates to other companies according to the settlement.

In spite of anti-trust pressure from the government regarding AT&T's Western Electric subsidiary monopoly on telephony CPE, AT&T staved off all attempts to interconnect non-AT&T equipment into the telephone network. One of the earliest interconnection technologies that AT&T had to defend itself from was a plastic device called the Hush-a-Phone that snapped onto telephone sets (earpiece and mouthpiece) so that conversations would be private. Hush-a-Phones were not electronic and could not cause negative externalities to ripple through AT&T's network. Nonetheless, AT&T defended (unsuccessfully) against the use of Hush-a-Phones in FCC hearings and in court from 1948-1956.

Competition in long distance began as MCI gradually chipped away at AT&T's monopoly of the telephone transport network once the FCC mandated new microwave interconnection rules. In 1969, MCI was allowed to offer inter-city microwave transmission for subscribers, beginning a new industry of SCCs (Specialized Common Carriers). Initially SCCs offered point-to-point circuits so that calls could be placed only among subscribers to the SCC's network and not to all telephones in the world as in the PSTN.

In 1974, MCI filed suit against AT&T, charging anti-trust violations such as monopolization and failure to interconnect. A final verdict in the case was not received until 1985, when AT&T was ordered to pay MCI $120 million dollars. In addition, in 1974, the Justice Department brought a suit that sought to force AT&T to spin off local service from the Bell System.

MCI also established its own long-distance service, Execunet, in 1975. To place a long-distance call, a local number (essentially a POP) was dialed and the long-distance caller entered a series of access codes to Execunet. Then, a call could be completed to PSTN telephones in any area code Execunet served, establishing in essence a long distance call through MCI's microwave relay network instead of AT&T's transport network. AT&T brought legal action arguing that such a service was outside the point-to-point nature of SCCs and was actually a long-distance call. In 1978, after protracted appeal, AT&T and the FCC (which took AT&T's side) lost the case to MCI. Competition in long distance was established. MCI also was allowed to provide FX (Foreign Exchange) service.

The Justice Department's 1974 suit reached settlement in 1982 with the breakup of AT&T. Since over 871,000 pages of testimony, exhibits, and pleadings were made in the case, only a bare summary of the main issues can be given. The essence of the government's case was in four areas. The first area concerned the right of SCCs to interconnect to AT&T's local or transport network. A second issue was the fact that Western Electric still provided equipment for the entire Bell System so that competition in switching and other telephone network equipment was stifled. A third issue was AT&T's refusal to allow CPE (owned by customers but made by non-AT&T manufacturers) to interconnect with the PSTN. AT&T insisted that customers with such non-approved CPE use only AT&T manufactured devices to permit interconnection. Fourth, and finally, was the issue of how the SCCs and bypass carriers should compensate AT&T for completing calls that were originated and transported over non-AT&T networks.

By 1982, parts of the Justice Department's objectives in the case had been obtained in the Execunet case or were being re-tried after a 1.8 billion dollar settlement in favor of MCI in MCI's own anti-trust case. Additionally, FCC and state regulatory authorities were liberalizing CPE interconnection rules. Greene (1997) argues that neither the government nor AT&T had anything to gain by waiting years for the trial and appeals process to grind on. Therefore, the case was postponed in early 1981 to allow settlement negotiations to be made.

According to Stone (1997, p. 81) the breakup settlement consisted of AT&T agreeing to:

divest its twenty-two local operating companies and withdraw from the local-loop business. In exchange, the Justice Department agreed to let AT&T keep its manufacturing arm and retain Bell Labs, the research facility, although AT&T agreed to help the seven newly formed RBOCs set up Bellcore, their own research facility. Most importantly, from AT&T's perspective, many of the restrictions on AT&T contained in the 1956 consent decree were lifted. [Stone, 1997, p. 81]

The settlement would be known as the MFJ (Modified Final Judgement) and was issued at the beginning of 1984. AT&T was now allowed into the computer business and permitted to remain in the nascent wireless (cellular) telephone business. AT&T had to spin off local telephone and other local services into the RBOCs who themselves were generally prohibited from offering long distance or non-regulated services. In addition to long-distance, AT&T was allowed to operate primarily in competitive markets such as data communications, network management, etc. The RBOCs had to allow equal access to long distance and directory assistance services provided by other companies, but were permitted to hold on to the lucrative Yellow Pages.

BellSouth Corporation, the RBOC that covered much of Florida (see Figure 5-6 later in this section) was formed through the merger of two AT&T spin offs, the Southern Bell Telephone Co. and South Central Bell Telephone Co. The MFJ allowed the seven RBOCs to each remain larger than GTE, the nation's second largest telephone company before and after the breakup. RBOCs could sell or lease CPE, but not manufacture it. The future of BellSouth, GTE, Sprint, and other ILECs (Incumbent Local Exchange Carriers) was assured within Florida as well. The MFJ changed the infrastructure and regulatory structure enough that ILECs could eventually be joined by new wireline carriers, such as ALECs (Alternative Local Exchange Carriers). IXCs (Interexchange Carriers) or long distance carriers were established by the MFJ.

However, POTS and enhanced telecommunications services provided by telcos are not the only story of wireline access and regulation to be recounted. Cable and electric companies bypass the local access level of the ILECs (using their own local loop) to provide POTS, enhanced telephony, Internet, and private data networking access. It would take new legislation, the 1996 TCA (covered in 5.3.3) to allow wireline regulation and infrastructure to admit new services and new carriers into the burgeoning hypercommunications market.

The technical side of cable TV infrastructure is covered in 4.3.3. Models suggest that to compete with the cablecos, there are two steps telcos must follow to provide cable broadband services via the telco plant. First, there is infrastructure construction as covered in Table 5-5. Second, there are service deployment and price structure. Nationwide, a revenue requirement per customer per month of $42 is needed just for construction, and $51 per month for service deployment. In rural areas, the figures are $64 and $72 per month per subscriber. However, to provide rural business infrastructure alone the construction cost per subscriber per month is estimated at $41 and $73 per customer per month for service deployment [Weinhaus et al., 1995].

Discussion of specific Internet and private data networking access technologies was given in 4.8 and 4.9. Importantly, wireline access to both depends on telco, cableco, or dark fiber infrastructures. The recent infrastructure and regulatory histories regarding these newer developments will have to wait until after the wireless story is told and the 1996 TCA is used to level the playing field and stimulate competition.

5.3.2 History of Wireless Infrastructure and Regulation

The regulatory history of the wireless sub-market is based on the original broadcast services of radio and television, which are non-interactive mass communications media. It was once necessary to have a radio receiver or TV tuner to receive live or taped broadcasts. Now, audio and video communications can be transmitted over the Internet, through private data networks, through the CATV infrastructure, or be heard and seen via CD, DVD, or videodisc. However, the FCC still regulates the airwaves with some surprising new twists such as spectrum auctions.

During World War I, AT&T was put to work on projects for the Army Signal Corps. It was out of Western Electric's development of air-to-ground, ground-to-air, and air-to-air communications that interpersonal wireless communications developed in the United States. In 1920, a Catalina Island radiotelephone link was established by AT&T due to postwar copper shortages. Another wireless operator, the American Marconi Company, was nationalized and privatized during World War I, but Marconi's business plan was focused on navigation, telegraph transmission, ship-to-shore, and radio broadcasting rather than person-to-person wireless.

The regulatory history of wireless began in 1912 when federal courts ruled that the Secretary of Commerce and Labor could not refuse radio licenses to any qualified applicant. The ruling came in spite of a developing "tragedy of the common airwaves" where shared public frequencies were creating massive interference. The problem became so serious that by 1929, there would be 50 fewer radio stations on the air than in September 1927 when there had been 757) [Doll, 1996]. Not until 1938 would the 1927 total be reached again.

Herbert Hoover's intervention as Secretary of Commerce changed the radio market into a larger-scaled, closely regulated, and more profitable business than it had been in pre-regulatory days. In 1927, Hoover was able to form the FRC (Federal Radio Commission) to phase in the allocation of frequency licenses. The telephone ICC and radio FRC merged into the FCC in 1934. The FCC became in charge of wireless spectra using its newly granted licensing powers.

It was not until after World War II that it became clear that wireless (specifically microwave) transmission could compete with AT&T's transport network. Spectrum allocations made by the FCC permitted mining companies, railroads, the oil and gas industry, and other firms to create their own microwave networks. AT&T opposed such moves, arguing that it had sole right to transport voice communication over microwave links. However in 1959, the FCC agreed to permit private microwave networks as long as they were not interconnected with the PSTN, opening the door to limited competition with AT&T in two-way voice communications.

By the late 1960's, digital microwave transmission became technically possible, bringing new pressure on AT&T's monopoly over the telephone transport system through which long-distance calls traveled. Changes in telecommunications transport cost economics and large customer bypassing were two policy issues that directly flowed from the rapid expansion in digital microwave technologies.

First, the availability of microwave changed the economics of telephone transport from its traditional natural monopoly footing. Support for this idea came as early as 1975 when

economist Leonard Waverman argued the advent of microwave as a long-distance transmission medium dramatically altered the (telephone) industry's economics, so that the natural-monopoly justification no longer existed as it had when open wire pairs were the principal medium for intercity wire traffic, which was the case until the 1940's. Accordingly, he urged in an influential paper [Waverman, 1975], increased competition was in the national interest. [Stone, 1997, p. 139]

Second, the availability of microwave transport in support of bypass carriers threatened to fragment the telephone market and wreak serious consequences on small local customers and local independent telcos.

At the time of the (AT&T) breakup the fear . . . that microwave would allow large business customers to bypass the local loop was widespread. . . . Lower local rates for large customers and higher access charges from long-distance companies to local companies were conceived as the most effective response to the threat, which would inexorably take its toll on the local operating companies. [Stone, 1997, p. 141]

There were two kinds of bypass involved: facility and service. With facility bypass, users built a microwave link or leased a line from a bypass vendor to connect the user directly to a long-distance location. Service bypass involves users purchasing private lines from the local operating company to reach a bypass carrier's POP [Stone, 1997, p. 142].

As was mentioned in 5.3.1, AT&T's breakup came because bypass carriers (such as MCI and Sprint) argued successfully that the economics of wireless transport had changed enough that AT&T's natural monopoly was worth protection. The first case of a company other than AT&T being allowed to interconnect with the PSTN came with the 1968 Carterfone case. Courts held that wireless Carterfones (predecessors of SMR) could be interconnected directly to the PSTN. Carterfone operated radiophone equipment mainly for use as a two-way dispatch system in the oil and gas industry, but operators could connect remote callers to the PSTN as well. AT&T bitterly fought Carterfone, but was forced to allow direct PSTN connection of other kinds of CPE (including computers and customer-owned microwave systems) due the precedent set by the monopoly's loss of the Carterfone case. AT&T retained the exclusive right to supply control devices to allow customers' computers access to the telephone network for data calls and sessions.

Another wireless area where AT&T faced challenges was in satellite communications, which it lost control of with the formation of Comsat (the Communications Satellite Corporation) in the 1962 Communications Satellite Act [Stone, 1997, pp. 53-57]. The FCC had jurisdiction over new private satellite firms who were allowed to provide long-lease service but not connect to PSTN due to the international Intelsat treaty. Much later, fiber optics (as a substitute technology to satellite transport) changed the equation again. By 1997, FCC endorsed elimination of Intelsat interconnection restrictions [Stone, 1997, p. 125].

Recent developments in wireless infrastructure are noteworthy for two reasons. First, the FCC has used economic theory to auction previously unallocated radio and microwave frequencies. This action has increased available spectra, making a variety of new services such as broadband PCS, digital cellular, and a variety of upperband services such as MMDS, LMDS, and DEMS possible. Spectral auctioning was proposed first in the early days of radio but was rejected. Professor Coase's 1959 article about the FCC was the first of many arguments used to show that auctions would be more efficient solutions than licensing alone [Coase, 1959]. The advice began to be taken with digital PCS auctions in the 1990's.

However, many of the newly auctioned frequencies are silent as new technologies and the wireless infrastructure needed to transmit at specialized wavelengths are deployed. Carriers are investing billions of dollars in tower construction to support cellular, PCS, GSM, and fixed wireless technologies that were covered in 4.4.2. While wireless access and transport offer great promise for rural communications needs, an infrastructure is still required, though in many cases wireless infrastructures may be built more cheaply than in the wireline case. Satellite communications, because it requires expensive launches of possibly large constellations of satellites, is currently more expensive than terrestrial wireless or wireline infrastructures as evidenced by the recent bankruptcy of the massive Iridium project.

Finally, the FCC also regulates broadcast stations including local rural radio stations. Local radio stations contribute substantially to their communities in financial and non-financial ways:

Much of what they do goes unnoticed outside the community and may not always be appreciated within the community--until the station goes silent or is moved out.

In many small towns, it is only the local radio station that carries the fact that a friend has passed on, or that a neighbor or relative has had a new baby, or the neighbor's barn burned, or that the county or city board is planning an increase in property taxes. These stations are the vehicles that carry urgent pleas for a blood donation to help save a local youngster's life, that the high school band needs a donation to march in the President's inaugural parade, that the school system is deficient in a vital but non-budgeted area. [Doll, 1996, p. 232]

However, a criticism of the FCC regarding the non-metro radio market is that the FCC has caused it to be overbuilt [Doll, 1996, p. 237].

It is unclear how the convergence of web broadcasting and new low power FM, HDTV, and spread spectrum technologies will change broadcasting. Just as ILECs, IXCs, RBOCs, and cableco offerings caused an uneven playing field to develop in wireline regulation, so too have mobile, fixed terrestrial, and satellite systems created regulatory inefficiencies in the wireless area. By the mid-1990's, it was plain that regulations could not keep up with the new services and technologies in the multi-faceted communications markets. As the future of convergence became more likely, there was enormous political pressure to replace the 1934 Communications Act with a regulatory framework capable of dealing with the communications infrastructure of the information economy.

5.3.3 Regulatory Pseudo-Convergence: The 1996 TCA

The need for unified legislation to replace the hodgepodge of regulations that applied to different services (from POTS to the Internet) and to different providers (from wireline RBOCs to wireless cablecos) became apparent by the early to mid 1990's. Regulation or the lack thereof is especially important in any analysis of sub-markets in the pre-converged hypercommunications sector. In studying the history of hypercommunications, it becomes clear that the regulatory environment depends closely on how markets define technologies and services. Yet, market definitions themselves depend on regulation. This dual relationship makes it hard for agribusinesses (used to a century's worth of thinking about communications as being provided by their monopoly ILEC) to get used to two important cost-cutting ideas about convergence that will simultaneously increase communication.

The first important idea about convergence (that the office telephone and computer are converging into one device) may be hard for some agribusinesses to imagine, since device-device convergence is in the early adoption stage. Second, perhaps easier to understand, and already available (thanks to competitive convergence and regulatory convergence) is the ability for an agribusiness to connect to two or more communication networks using one connection and one carrier. Adoption of the second idea requires accepting the idea that the hypercommunications marketplace will not be monopoly-controlled, even if the telecommunications marketplace was. However because of technological change, this idea was a theoretical possibility before 1996, but it only became possible with the passage of state and federal de-regulation legislation.

Recall from section 4.1 that there are more than two dimensions to convergence. However, device-device convergence, market convergence, and regulatory convergence are infrastructure-related. While device-device convergence stems from the local infrastructure owned by the agribusiness including CPE (Customer Premise Equipment), DCE (Data Communications Equipment), and DTE (Data Terminal Equipment), the other two convergences depend on outside infrastructure. Regulation is designed to bring infrastructure to rural areas so that high-speed hypercommunications will be both accessible and inexpensive. A fringe benefit of deregulation is new competition from firms previously in separate sub-markets now that multiple infrastructures (wireline telecommunications, cableco, fixed wireless, mobile wireless, and dark fiber) are available. However, since nothing prevented AT&T from buying the cable companies MediaOne and TCI, while continuing to offering long-distance and both fixed and mobile wireless services, market convergence might mean fewer providers.

The 1996 TCA (Telecommunications Act, Public Law 104-104) was signed by President Bill Clinton on February 8, 1996 [Thomas, 1998]. The exact date is important because time has sped up in the Information Age. Compressed time makes it more important strategically for regulators and industry alike to keep up with competitors, new technologies, and new services. Florida passed its own state deregulation bill in 1995, before the federal 1996 TCA went into effect.

The U.S. Senate had passed its version of the TCA (S. 652) by a vote of 81-18 on June 15, 1995, while the House passed its telecommunications measure (H.R. 1555) on October 15, 1995 [Thomas, 1998]. Though enaction had been expected during 1995, powerful interests successfully lobbied the House-Senate Conference Committee and the White House to delay the bills, knowing the Clinton administration and Congress both were expecting a tough election battle in 1996. W.T. Stanbury's 1996 chronology of US press accounts quotes the October 16, 1995 Business Week as saying:

Delay gives more time for regrouping by the White House--which has threatened a veto over cable deregulation, media concentration, and the terms under which the Bells can get into long distance. Other bill opponents include several major consumer organizations. The longer passage takes, the more leverage critics will have to extract concessions. [Stanbury, 1996, p. 23]

Some critics alleged that the legislative playing field had been tainted by campaign contributions and while the field was not completely level, contributions from each special interest category may have tended to offset one another. Perhaps no solution could balance the needs of a diverse set of local telephone companies (ILECs, ALECs, and RBOCs), long-distance telephone companies (IXCs), cable TV providers, software makers like Microsoft, and data and enhanced telecommunication CPE and DCE manufacturers. A host of (at the time) smaller players rounded out the list of affected parties. These included satellite carriers, cellular telephone companies, newspapers, radio and TV stations, educational institutions, ISPs, microwave carriers, and other firms who had begun to gobble up new wireless frequencies at FCC auctions.

The historical local telephone monopolies (ILECs in general and RBOCs in particular) had the most to gain and lose. The MFJ had prohibited them from the long-distance business and imposed a cumbersome patchwork of LATAs that affected dedicated point-to-point and circuit-switched connections sold for private data network use as well. Furthermore, ILEC responsibilities as carrier of last resort and the decisions they made concerning rural and urban infrastructure were at stake. Also endangered was the enormous capital investment on their own access and transport networks that ILECs would now be expected to allow new competitors called CLECs (Competitive Local Exchange Carriers) to interconnect with. Under the TCA, these former monopolies would still have to provide universal service to any business or residential customer.

Florida ILECs (shown in Figure 5-6) included the giant RBOC BellSouth along the East Coast and certain inland locations through the state, GTE in the Tampa Bay area, and Sprint. Sprint's Florida territories are products of the Centel and United telco acquisitions mainly in Southeast Florida and the Tallahassee area.

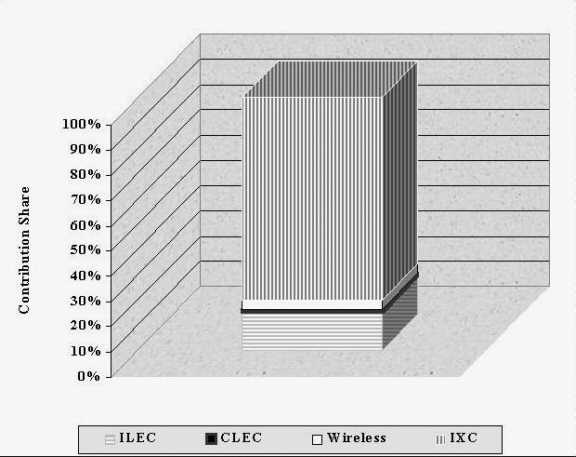

Certain rents, regulatory obligations and credits, special taxes, and assessments flowed to the ILEC in each part of Florida before the TCA because of existing state and federal legislation and FPSC actions. After the TCA, it was left to a combination of the market, and federal and state regulators as to what each ILEC would be required to do to furnish "universal service" to customers. In 1996, BellSouth, GTE, and Sprint had 59, 21, and 18 percent respectively of local access lines in Florida [Florida Statistical Abstract, 1997, Table 14.60, p. 435].

The lightest area in the map shows (denoted as other in the key to Figure 5-6) shows the smaller independent ILECs of Florida. Independent ILECs are small companies that had competed against the former Bell System in an earlier age of communications deregulation (before the 1934). When the present regulatory era began with the 1934 Communications Act (the organic statute of the 1996 TCA), independents were permitted to continue serving their markets. Many of those such as Alltel's North Central Florida territory were cobbled together when an existing telecommunications company purchased an existing ILEC. Others were rural telephone co-operatives.

According to RBOC U.S. West (now Qwest) Communications president Solomon Trujillo, ILECs have been trapped into an unfair and discriminatory bind by the 1996 TCA. Specifically the TCA did three things to limit RBOC operations. First, the TCA has deregulated the lucrative local line business while allowing competitors (ALECs) full right of interconnection to ILEC access and transport networks. Secondly, the TCA also mandates that ILECs (especially RBOCs) not do business in certain hypercommunications segments such as interstate long-distance.

Third, ILECs are carriers of last resort (covered further in 5.5.3), meaning they must provide service to high-cost hard-to-serve areas although infrastructure competitors do not have the same obligations. For example, cable TV rates were deregulated, but cablecos are subject to state regulation as ALECs if they provide local telephone service. Data communication, traditionally divided into basic and enhanced categories, saw the continuation of certain basic tariffs, while online services such as ISPs and OSPs were generally free from regulation. Other aspects of the TCA were discussed (along with universal service) in 5.2.3 and will be revisited elsewhere in Chapter 5.

5.4 Rationales for Government Involvement

The next three sections consider rationales (5.4), mechanisms (5.5), and the evolving economics of government involvement (5.6) in converged hypercommunications. Although seven policy bases for universal service (discussed when defining the term in 5.2.3) are important rationales for government involvement, there are broader rationales. As Alan Stone writes, the rationale for government involvement in hypercommunications has moved into an era of privatization and de-regulation. However, government will still need to play a role: